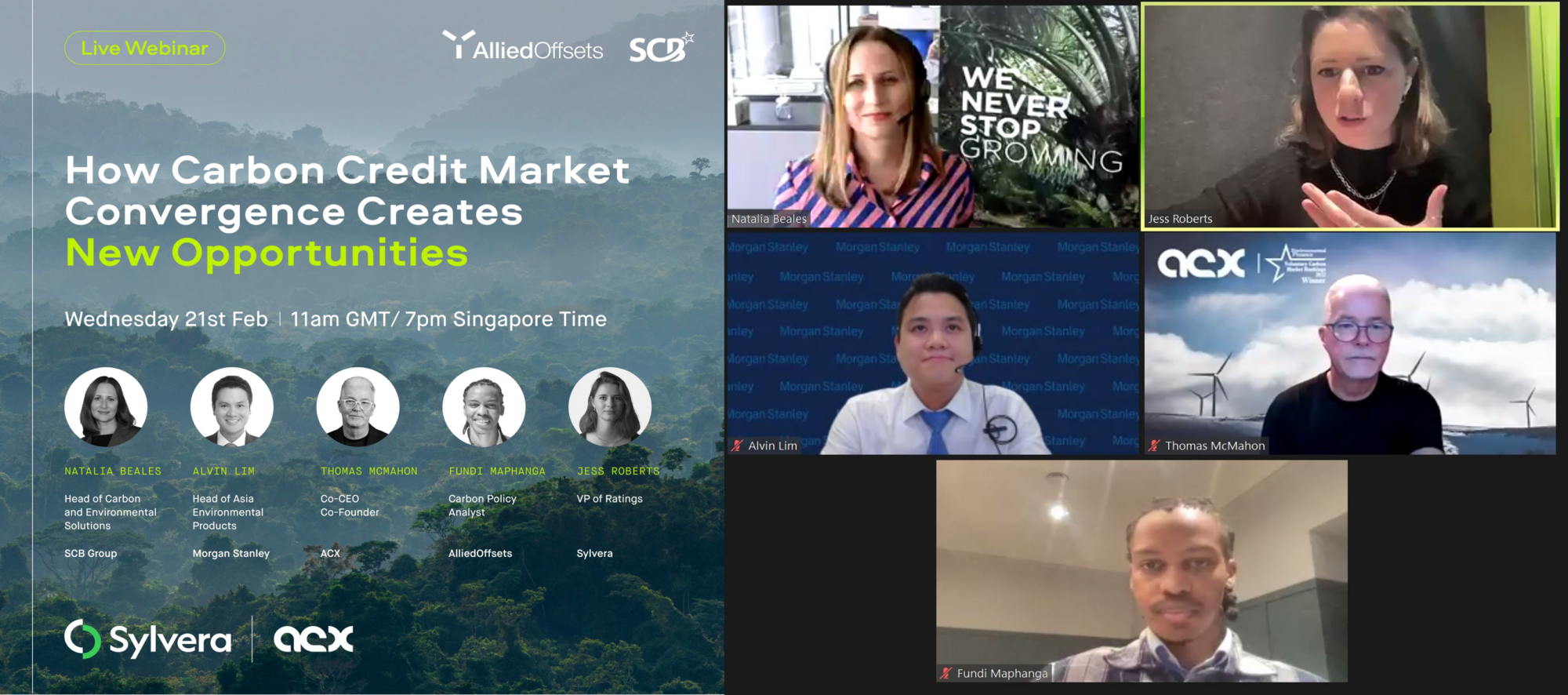

SCB’s Head of Carbon, Natalia Beales shares her insights on climate action in a webinar ‘How Carbon Credit Market Convergence Creates New Opportunities’, hosted by Sylvera.

A notable shift is underway as the voluntary carbon market (VCM) and compliance markets have been increasingly converging, driven by two key trends; increased regulation in the VCM and the expansion of compliance markets.

Carbon credits are playing a larger and more visible role as the ‘net’ in ‘net zero.’ As these waves continue, the VCM’s role in the net zero economic transition is becoming even more important.

The expert panel delved into why this is an opportunity to strengthen quality and transparency, and how buyers can take advantage of this opportunity and navigate this change. The panel consisted of Natalia Beales, Head of Carbon and Environmental Solutions, SCB Group; Thomas McMahon, Co-CEO & Co-Founder, ACX (AirCarbon Exchange); Alvin Lim, CFA, CMT, Head of Asia Environmental Products, Morgan Stanley and Fundi Maphanga, Carbon Policy Analyst, AlliedOffsets gave their insights, with moderation by Jess Roberts, VP of Ratings, Sylvera.

SCB’s Natalia was posed the question: What are the main ways the markets are converging in 2024 and what are the drivers?

Natalia shares her expert views, summarised as follows: “We should take a few minutes to understand the goals of both the Compliance market and the VCM. Although both aim to reduce greenhouse gas (GHG) emissions, they utilize distinct incentive mechanisms for this purpose. Cap-and-trade programs and carbon taxes, for instance, discourage emissions through penalties, thus curtailing unsustainable practices.

On the other hand, the VCM, particularly through initiatives like reforestation, afforestation, clean cooking, clean water programs, or direct air capture, promotes carbon removal or reduction, encouraging sustainable activities.

There’s a clear distinction between discouraging negative behavior and promoting positive actions, which significantly affects how each market defines its scope. For instance, implementing a cap-and-trade program or a tax scheme on a regional basis might struggle to address issues like biodiversity loss or the protection of the Amazon forests.

A unique aspect of the VCM includes its consideration of non-carbon factors, closely aligned with the United Nations Sustainable Development Goals—such as preventing biodiversity loss, alleviating poverty, and providing clean resources to communities in the global south, who are most affected by climate change.

Despite their differences, the histories of these two markets are closely intertwined, with future directions shaped by factors like climate finance. Compliance markets, currently valued at just under $1 trillion, have the potential to grow significantly by 2028. The VCM, in contrast, is evaluated at around $2 billion. The gap in climate finance, currently not meeting needs, is significant. To bridge this, an estimated $3.5 trillion per year is necessary. This gap highlights both a financial and emissions challenge, suggesting that the VCM and net-zero efforts, supported by private finance, could play crucial roles in addressing these issues.

Consumer demand for sustainable practices and investor interest in sustainable metrics are driving the integration of the VCM within compliance markets. An example is CORSIA, the aviation scheme, which has started to change the market dynamic by mandating eligible voluntary carbon units for international flights across 126 countries.

Additionally, the alignment of CORSIA with Article 6 of the Paris Agreement and the introduction of Article 6 labels by VCM registries exemplify the merging of voluntary and compliance efforts. This convergence is further evidenced by the European Parliament and Council’s recent provisional agreement on a carbon removal certification framework, indicating a broadening acceptance of voluntary measures within compliance frameworks.

The scrutiny of carbon markets, regarding corporate pledges and project crediting, highlights the regulatory interest in ensuring market integrity. The involvement of regulatory bodies like the CFTC and IOSCO in developing frameworks to oversee and assess the markets underscores a commitment to maintaining credibility and trust in these evolving systems.”

Fellow panellists went on to explore issues such as the benefits of integrating voluntary carbon credits into compliance markets, including enhanced investment, competition, and quality; Strategies for corporations to leverage these emerging opportunities; and global receptivity towards the integration of these markets.