How

How We Broker

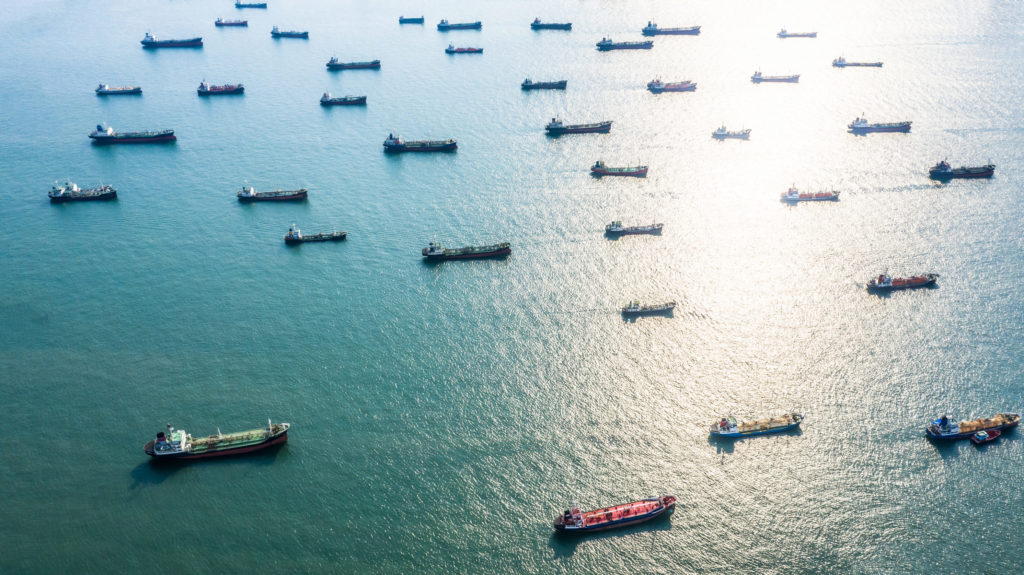

Our methanol desk facilitates markets with the largest consumers, producers and traders on the global market. We assist them to lock in margins, manage risk and also take appropriate views on the forward curve. This occurs through execution of methanol futures and swaps, which are hedged via OTC cleared exchange traded, financially settled products.

We also manage daily physical spot exposure in some of the major ports where methanol is stored globally: Rotterdam, Houston, South East Asia and China. Through our expertise and broad network, we acquire customised market information for each client profile alongside live updates on the market.

What

What We Offer

- Methanol risk management tools, hedging via OTC cleared exchange traded, financially settled futures.

- Live updates on the market minute to minute.

- Customised market information for each client profile.

- Daily spot coverage in the major ports where methanol is stored globally.

Contacts

- Methanol Desk LowCarbon@starcb.com Subscribe to our reports